GOVERNMENT ACCEPTS CARESHIELD LIFE COUNCIL’S RECOMMENDATIONS TO ENHANCE CARESHIELD LIFE, PROVIDES ADDITIONAL $570 MILLION TO SUBSIDISE PREMIUMS

27 August 2025

The Government has accepted the CareShield Life Council’s recommendations for the CareShield Life 2025 Review.

2. The Council has recommended higher payouts, with greater support from the government to cushion the resulting premium increases. To help policyholders cope with these increases, the Government will provide over $570 million more in premium support over the next five years. All premiums will remain fully payable by MediSave and no one will lose CareShield Life coverage due to an inability to pay their premiums.

3. The Council’s recommendations will help ensure that CareShield Life continues to support Singaporeans in meeting their basic long-term care needs if they develop severe disability. The scheme changes will be implemented progressively from January 2026.

Support Measures to Enhance Long-Term Care Affordability

4. Long-term care costs have been increasing. This is due to evolving care needs of the population, and inflation, driven by manpower and technology costs. To keep long-term care affordable, the Government announced substantial subsidy and grant enhancements at Budget 2025. These include:

(a) Enhancing long-term care service subsidies from July 2026, which includes

i. Raising long-term care service subsidies by up to 15 percentage points to a maximum of 80%;

ii. Introducing additional cohort subsidies1 of 5 percentage points for residential long-term care and 15 percentage points for home and community long-term care; and

iii. Raising the per capita household income (PCHI) eligibility threshold for long-term care subsidies from $3,600 to $4,800, which will benefit more households.

1 For Singapore Citizens born in 1969 or earlier

(b) Enhancing Home Caregiving Grant payouts to up to $600 per month from April 2026, up from the current $400 per month, and raising the PCHI eligibility threshold from $3,600 to $4,800; and

(c) Enhancing subsidies for home healthcare items and devices under the Seniors’ Mobility and Enabling Fund, expanding the list of home healthcare items covered, and raising the PCHI eligibility threshold from $2,600 to $4,800, from January 2026.

5. Besides subsidy and grants, CareShield Life, our national long-term care insurance, also plays an important role in supporting long-term care affordability. The CareShield Life Council was tasked by the Minister for Health to review the scheme earlier this year and released their recommendations on 27 August 2025.

CareShield Life Council’s recommendations

Enhancement to Payouts and Coverage

6. In its review, the Council engaged the public, stakeholders, and experts to better understand Singaporeans’ views towards long-term care planning. The Council considered how the CareShield Life scheme could be refined to better provide basic long-term care protection for Singaporeans, whilst ensuring that premiums continue to remain affordable.

7. With these factors in mind, the Council has recommended doubling the growth rate of CareShield Life payouts from 2% to 4%, while maintaining its claims eligibility criteria. With this enhancement, a policyholder making a claim in 2030 will receive $806 per month, compared to $731 per month under the previous annual growth rate. More details can be found in Annexes A and B.

Premium Adjustments

8. Premiums will need to increase in order to sustain the higher payouts. To keep premiums affordable and fair, the Council recommends two measures:

(a) Adjust the scheme’s underwriting criteria for older individuals, as planned. Today, CareShield Life is kept optional for older individuals born in 1979 and earlier, as many may have made other plans for their long-term care needs. The Government had provided participation incentives to support their enrolment. As an added time-limited measure, older individuals even with mild and moderate disability were able to enrol onto the scheme when it was first introduced. After an extended grace period of more than four years since 2021 and with sign-up rates dwindling significantly by 90%, the Council recommends reinstating the underwriting criteria as planned. This will moderate the extent of premium increases for all older policyholders and keep the scheme fair and sustainable.

(b) Provide transitional support. To help Singaporeans cope with premium increases in general, the Council recommends that the Government consider providing transitional premium support to policyholders, to moderate and phase in the premium increases.

More details on premium adjustments and premium support can be found in Annex C.

Improvements to Claims Process and Scheme Administration

9. Based on feedback received during the Council’s engagements, the Council recognises and recommends that more be done to improve accessibility to disability assessments and simplify applications to disability schemes, including CareShield Life. This will reduce the administrative burden for long-term care recipients and their caregivers, and enhance the claims experience for policyholders.

Government accepts the recommendations and will provide significant premium support

10. The Government has reviewed the Council’s recommendations and accepts them in full.

11. The Government affirms the importance of focusing CareShield Life on supporting those with severe disability. Singaporeans who require long-term care for milder levels of disability will continue to be supported through various long-term care subsidies and grants. They may also purchase Supplements that are offered by private insurers.

12. As for premium support, over the next five years, the Government will provide more than $570 million in additional support, on top of the existing premium subsidies today. This comprises:

(a) Broad-based transitional support of $440 million. This will moderate the extent of premium increase for all affected policyholders, and evenly phase in the increases from 2026 to 2030.

(b) More means-tested premium support for the low- to middle-income of over $130 million. The higher premiums will be offset by premium subsidies of up to 30% for eligible policyholders.

(c) Expansion of Additional Premium Support. The Government has expanded the eligibility criteria for this scheme, to support Singaporeans who are unable to afford their CareShield Life premiums after premium subsidies and have limited family support. Eligible policyholders will be invited to apply for this support.

13. Without these support measures, annual premiums would have increased by $126 on average in 2026 and grown by 4% thereafter. With the support measures, annual premium increases from 2026 to 2030 will be moderated to about $38 on average, and no more than $75. Low- to middle-income Singaporeans will see even lower premium increases, as they will continue to receive means-tested premium subsidies. No one will lose coverage due to an inability to pay their premiums.

14. The enhanced payouts and premiums will be applicable from 2026 to 2030, and will be reviewed thereafter to ensure that these remain meaningful and sustainable.

15. The Government will be streamlining the processing and assessment of related long-term care grant schemes. Residents who undergo severe disability assessment for a long-term care scheme, such as CareShield Life, will soon also be assessed against the eligibility criteria for other related schemes (e.g. the Home Caregiving Grant). If the eligibility criteria for these other schemes are met, care recipients will receive support from the relevant schemes without the need to make additional applications. We will continue to look out for opportunities to further improve the assessment and claims experience for long-term care recipients and their caregivers.

16. The Government thanks the Council for their time and effort to review the CareShield Life scheme. In arriving at its recommendations, the Council has engaged widely and carefully considered all aspects of the scheme. The Council’s recommendations will allow us to strike an appropriate balance between providing greater protection for Singaporeans who require long-term care for severe disability while keeping premiums affordable for all policyholders.

Annex A

Changes to the monthly CareShield Life payout^ from 2026 to 2030

| 2026 | 2027 | 2028 | 2029 | 2030 |

Current | $676 | $689 | $703 | $717 | $731 |

Enhanced | $689 | $717 | $745 | $775 | $806 |

^ The monthly CareShield Life payout that individuals are eligible for increases annually until you are age 67, or when a claim is made, whichever is earlier. They will remain insured at that payout sum thereafter.

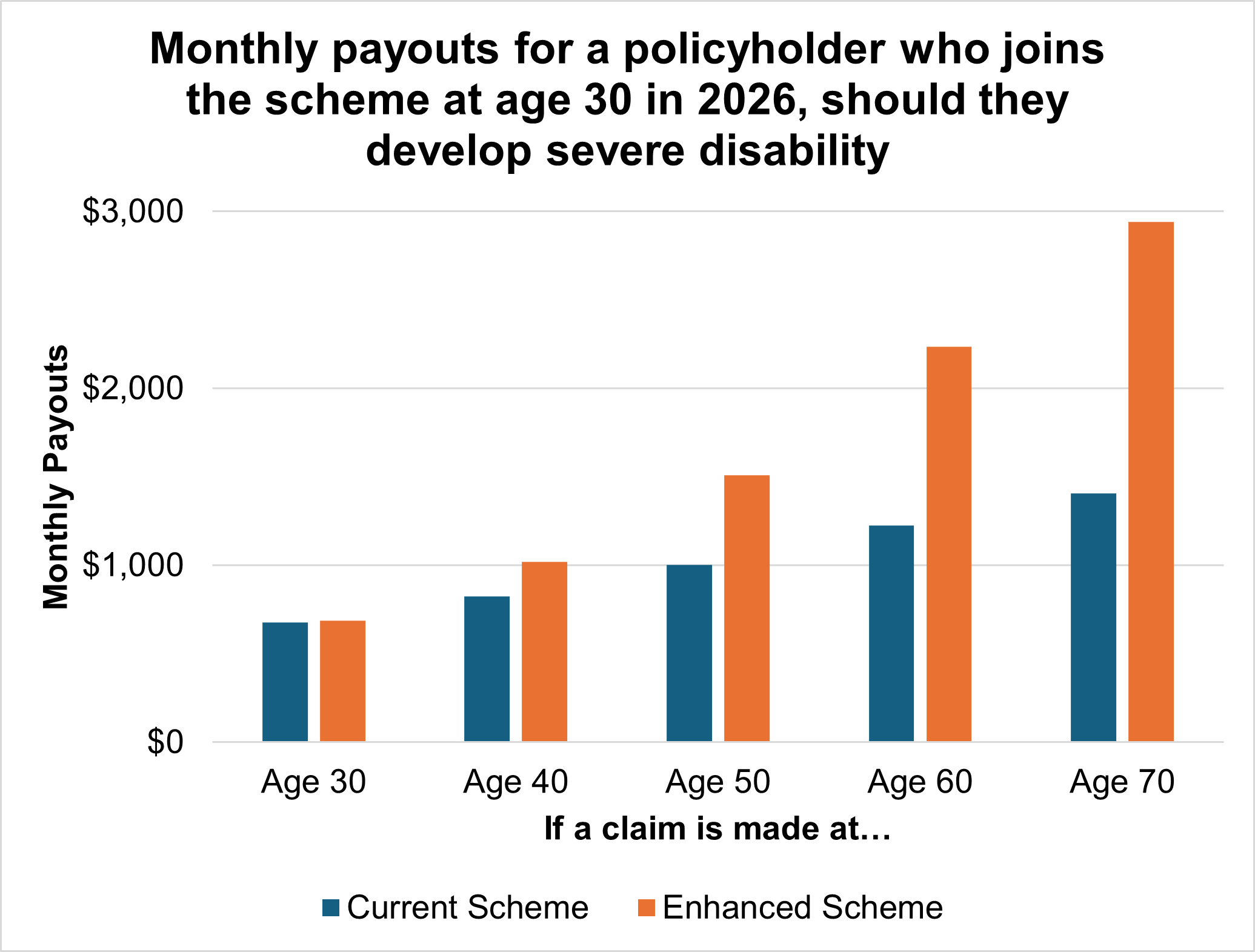

Assuming that payouts continue to grow at 4% p.a. thereafter, payouts for a 30-year-old who joins the scheme in 2026 will be as follows:

Annex B

Bill Examples Incorporating CareShield Life Scheme Changes

The monthly out-of-pocket costs based on a CareShield Life policyholder in 2026 with severe disability, with a Per Capita Household Income of $1,500.

Community Care | ||

Estimated monthly costs for an individual with severe disability, which includes

$2,700 | Long-term care financing schemes | |

Contributors including:

| $1,900 | |

Insurance payouts including:

| From approximately $689 onwards | |

Monthly out-of-pocket cost (after Government support and insurance payouts) | Approximately $110 | |

Nursing Home | ||

Estimated monthly costs for an individual with severe disability, which includes

$4,900 | Long-term care financing schemes | |

Government Support:

| $3,700 | |

Insurance payouts including:

| From approximately $689 onwards | |

Monthly out-of-pocket cost (after Government support and insurance payouts) | Approximately $510 | |

Note: Assume cohort-based subsidies not applicable

Those with severe disability can also choose to withdraw up to $200 monthly via MediSave Care to further reduce their out-of-pocket costs.

Annex C

Details of the CareShield Life 2025 Review Premium Support Measures

CareShield Life premiums have two components which are both fully payable by MediSave:

(i) Base Premiums: Base premiums are paid by all policyholders from the age they join until age 67, or for a period of 10 years for those who join CareShield Life at age 59 or older. Base premiums increase over time, together with the increase in payouts, until a policyholder reaches age 67.

(ii) Catch-up component: The catch-up component is a flat amount paid over 10 years in addition to the base premium. Groups such as existing ElderShield 300 policyholders, those not insured under ElderShield, and those who opted into ElderShield late, will need to pay this catch-up component, as they would not have paid as much premiums as those in the same cohort who had been consistently insured under the ElderShield 400 scheme.

Further subsidies and support are available to make sure they remain affordable. These include:

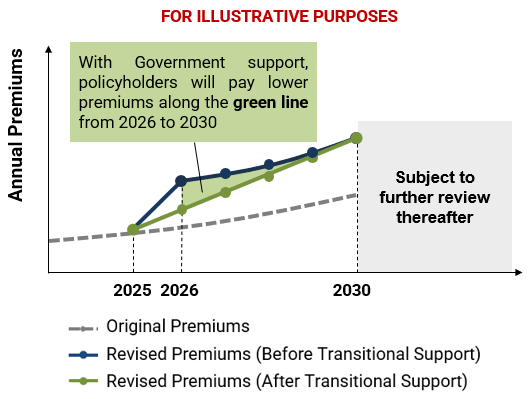

(i) [New] Transitional Support: Government top-up to the CareShield Life and ElderShield Insurance Fund, which will directly moderate and evenly phase in the extent of premium increases for all affected policyholders who see an increase in premiums.

Fig 1: Illustrative example of annual premiums payable

*Premium payments will still cease at age 67, or when a claim is made.

(ii) Premium subsidies: Policyholders from low- to middle-income households may receive subsidies of up to 30% of base premiums.

(iii) Participation incentives and additional participation incentives for optional cohorts: Policyholders from the optional cohort who opted into CareShield Life before 31 December 2024 will continue to receive up to a total of $4,000 of participation incentives, which are spread out and used to offset premiums over 10 years.

(iv) Additional Premium Support: Policyholders who are unable to afford their CareShield Life premiums after premium subsidies and family support may be eligible for additional premium support.

Individuals may check their personalised premiums through the CareShield Life premium checker from November 2025 onwards.

Annex D

Household Archetypes and Worked Examples

(1) Premium Impact on a young policyholder

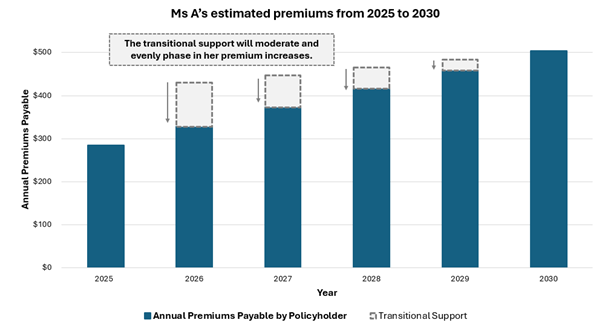

Illustration 1: Premium Impact for Ms A

· Born in 1990 and enrolled into CareShield Life in 2020, when she turned 30 years old

· Lives in a 3-room HDB flat

· Monthly Per capita household income more than $3,600

She will enjoy transitional support of $251 from 2026 to 2029, which will moderate and evenly phase in her premium increases. This will be directly reflected in her base premiums.

Figure D-1: Illustrative example of Ms A’s premiums from 2025 to 2030

Table D-1A: Illustrative example of payouts with CareShield Life enhancements

Year in which onset of severe disability occurs | Monthly Payouts (Current scheme) | Monthly Payouts (Enhanced scheme) |

Age 35 in 2025 | $662 | |

Age 55 (20 years later) | $984 | $1,452 |

Age 67 (32 years later) | $1,248 | $2,324 |

Note: Payouts remain level during period of severe disability. Assumes payout continue to grow at 4% per annum up to age 67, or point of claim.

(2) Premium impact on a middle-aged policyholder

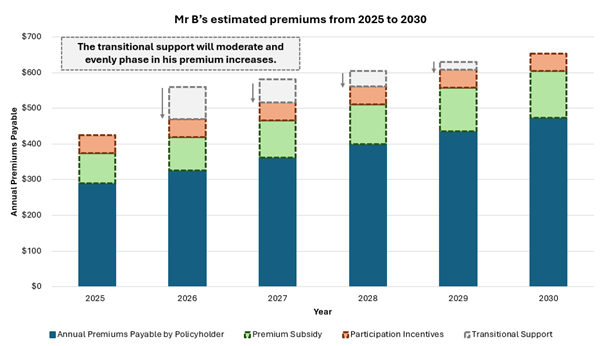

Illustration: Mr B

· Born in 1975 and enrolled into CareShield Life in 2021, when he was 46 years old

· Lives in a 4-room HDB flat

· Monthly Per capita household income of $3,600

· Previously on ElderShield 400

Mr B would enjoy transitional support of $219 from 2026 to 2029, which will moderate and evenly phase in his premium increases. This will be directly reflected in his base premiums.

Mr B would additionally enjoy means-tested premium subsidies of 20% off his base premiums. He is also eligible for $50 of participation incentives annually for 10 years to offset his premiums, as he joined the scheme before 31 December 2024.

Figure D-2: Illustrative example of Mr B’s premiums from 2025 to 2030

Table D-2A: Illustrative example of payouts with CareShield Life enhancements

Year in which onset of severe disability occurs | Monthly Payouts (Current scheme) | Monthly Payouts (Enhanced scheme) |

Age 50 in 2025 | $662 | |

Age 67 (17 years later) | $928 | $1,290 |

Age 80 (30 years later) | $928 | $1,290 |

Note: Payouts remain level during period of severe disability. Assumes payout continue to grow at 4% per annum up to age 67, or point of claim.

(3) Premium impact on a Merdeka Generation Policyholder

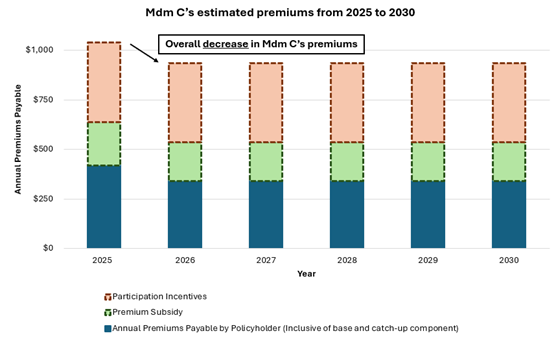

Illustration: Mdm C, who is from the Merdeka Generation

· Born in 1952 (Merdeka Generation) and enrolled into CareShield Life in 2021, when she was 69 years old

· Monthly Per Capita Household Income $2,600

· Lives in a 3-room HDB flat

· Joined ElderShield 300 in 2002

Mdm C will see reductions in her base premiums from 2026 onwards, due to the underwriting criteria adjustments. As such, transitional support is not provided.

Nonetheless, Mdm C would additionally enjoy means-tested premium subsidies of 25% off her base premiums. She is also eligible for $400 of participation incentives (which includes an additional $150 of additional participation incentives for the Merdeka Generation) annually for 10 years to offset to her premiums, as she joined the scheme before 31 December 2024.

For this policyholder, her premium term is over 10 years (i.e., 2021 to 2030).

Figure D-3: Illustrative example of Mdm C’s premiums from 2025 to 2030

Table D-3A: Illustrative example of payouts with CareShield Life enhancements

Year in which onset of severe disability occurs | Monthly Payouts (Current scheme) | Monthly Payouts (Enhanced scheme) |

Age 73 in 2025 | $612 | |

Age 80 (7 years later) | $612 | |

Note: Payouts remain level during period of severe disability. Payout no longer increases after age 67. Mdm C’s eligible payouts will remain the same, though her premiums have decreased.

(4) Premium impact on a Pioneer Generation policyholder

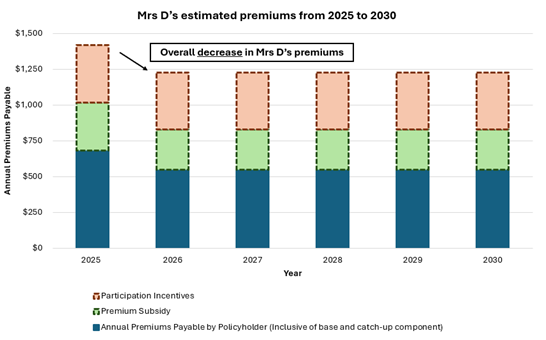

Illustration: Mrs D, who is from the Pioneer Generation

· Born in 1945 and joined CareShield Life in 2021 at age 76

· Monthly Per Capita Household Income $1,500

· Lives in a 2-room HDB flat

· Joined ElderShield 300 in 2002

Like Mdm C, Mrs D will see reductions in her base premiums from 2026 onwards, due to the underwriting criteria adjustments. As such, transitional support is not provided.

Nonetheless, as she is of lower income, she would additionally enjoy means-tested premium subsidies of 30% off her base premiums. She is also eligible for $400 of participation incentives (which includes an additional $150 of additional participation incentives for the Pioneer Generation) annually for 10 years to offset to her premiums, as she joined the scheme before 31 December 2024.

For this policyholder, her premium term is over 10 years (i.e., 2021 to 2030).

Figure D-4: Illustrative example of Mrs D’s premiums from 2025 to 2030

Table D-4A: Illustrative example of payouts with CareShield Life enhancements

Year in which onset of severe disability occurs | Monthly Payouts (Current scheme) | Monthly Payouts (Enhanced scheme) |

Age 80 in 2025 | $612 | |

Note: Payouts remain level during period of severe disability. Payout no longer increases after age 67. Mrs D’s eligible payouts will remain the same, though her premiums have decreased.