NEW REQUIREMENTS FOR INTEGRATED SHIELD PLAN RIDERS TO STRENGTHEN SUSTAINABILITY OF PRIVATE HEALTH INSURANCE AND ADDRESS RISING HEALTHCARE COSTS

26 November 2025

The Ministry of Health (MOH) is introducing new design requirements for Integrated Shield Plan (IP) riders to address rising insurance premiums and private healthcare costs.

2. From 1 April 2026, new IP riders sold will no longer be permitted to cover the minimum IP deductibles set by MOH. The co-payment cap will also be raised to a minimum of $6,000 to keep pace with the increase in bill sizes over time. The cap will apply to co-payments excluding the minimum IP deductible. Singaporeans can expect the new riders to be much more affordable, with premiums of new private hospital riders expected to be about 30% lower on average, compared to existing riders with maximum coverage. Singaporeans who purchase the new IP riders can benefit from lower premiums while still having assurance against catastrophic medical bills.

New Requirements for IP Riders

3. Today, policyholders can buy a rider together with their main IP to limit their co-payment, mainly for private healthcare. However, while very comprehensive coverage that protects up to almost the last dollar can confer ‘absolute peace of mind’ to the policyholder, it can be very expensive and drives up healthcare costs. With minimal co-payment, there is a greater tendency for over-servicing by healthcare providers and higher risk of over-consumption of healthcare services by patients. Our data shows that private hospital IP policyholders with riders are 1.4 times as likely to make a claim, with an average claim size of 1.4 times as those without riders. As a result, bill sizes and claims are rising significantly; this in turn drives up insurance premiums, especially for riders.

4. To arrest this cost and premium escalation trend for private healthcare, we need to moderate the coverage of IP riders.

a. From 1 April 2026, new IP riders sold will no longer be permitted to cover the minimum IP deductibles set by MOH1, which are meant to instil discipline in healthcare consumption in the first place.

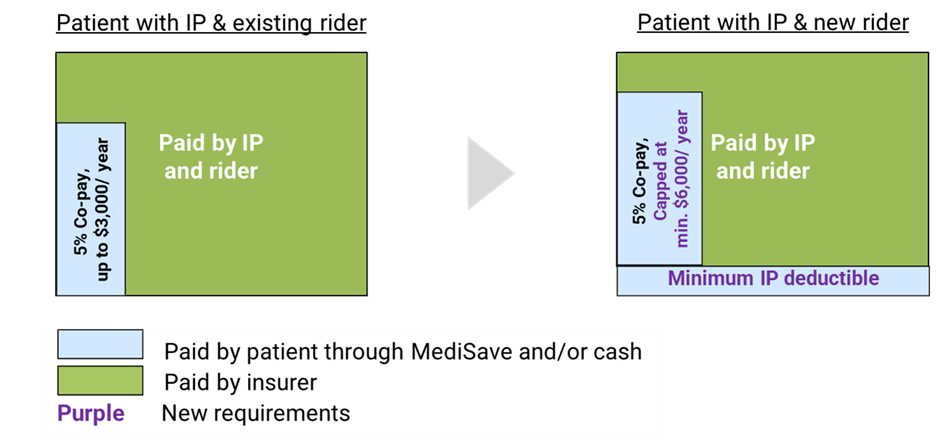

b. The co-payment cap, which was set at a minimum of $3,000 per year in 2018, will also be raised to a minimum of $6,000 per year to keep pace with the increase in bill sizes over time. The cap will apply on co-payments excluding the minimum IP deductible. The deductible and co-payments can be paid using MediSave, subject to prevailing withdrawal limits. There is no change to the minimum 5% co-payment requirement. An illustration of the new requirements and the minimum IP deductibles set by MOH can be found in Annex A.

1MOH sets the minimum IP deductible that each IP is required to have. This ranges from $1,500 to $3,500 per policy year, and varies by ward class (see Annex A).

5. These changes will help to bring health insurance back to its original objective, which is to protect patients against larger healthcare bills. It will increase cost discipline over minor episodes, and reduce over-servicing and over-consumption associated with non-essential hospital admissions or treatments. At the same time, the co-payment cap still limits the maximum amount of out-of-pocket cash one would need to pay, providing assurance to policyholders.

6. Singaporeans can expect the new riders to be much more affordable compared to existing riders on the market today. On average, the premiums of new IP riders are expected to be about 30% lower than existing riders with maximum coverage. This translates to annual premiums savings of around $600 for private hospital IP rider policyholders and around $200 for public hospital rider policyholders, on average, with older policyholders enjoying greater premium savings. Illustrations of claims payout and premium savings under the new riders can be found in Annex B.

7. While the changes entail more co-payment for smaller bills, they should not stop patients from seeking care when it is needed. Patients should continue to discuss their care options with their healthcare providers, who will advise on the recommended treatments based on established clinical practice and medical necessity.

Implementation Timeline

8. Insurers will launch new IP riders that comply with the revised requirements by 1 April 2026. They will cease sales of non-compliant riders on the same day. Insurers can continue selling existing riders until 31 March 2026 but must inform new policyholders who purchase such riders on or after 27 November 2025 that they will transition to riders that meet the new requirements no later than their next policy renewal after 1 April 2028.

9. As existing rider policies are contracts between insurers and their policyholders, individual insurers will further study and determine their own approach for their existing rider policyholders. In the meantime, existing rider policyholders who purchased their policies before 27 November 2025 may wish to speak to their financial advisors and consider if the new IP riders better suit their needs.

10. Over time, the changes to rider design should help moderate overall healthcare cost and disrupt the current spiral of rising costs and escalating premiums.

11. These latest changes are part of a suite of measures that MOH has been taking to address rising private healthcare costs, including setting fee benchmarks to guide charging practices, taking enforcement action against the small minority of doctors who make inappropriate claims, and exploring the feasibility of a new not-for-profit private hospital. All stakeholders, including hospitals, doctors, insurers and consumers, will need to continue to play their part to bring private healthcare and health insurance onto a more sustainable path.

ANNEX A

Illustration of New Rider Design

Figure 1: New requirements for IP riders from 1 April 2026

^ Deductibles are fixed amounts payable by the patient before insurance pays out, and only have to be paid once per year. Multiple bills in the same year can add towards the deductible.

* Co-payment cap only applies to eligible claims such as panel or pre-authorised claims. The minimum co-payment cap will apply to co-payments excluding the minimum IP deductible.

The prevailing minimum IP deductibles as at November 2025 are as shown in Table 1. The minimum IP deductibles may be updated from time to time.

Table 1: Minimum IP deductibles

Targeted Coverage of the Insured Person’s IP | Ward Class Utilised by Insured Person | Minimum Deductible* Lower of Target IP Coverage or Ward Class Utilised |

Class A/Private | Class A/Private | $3,500 |

Class B1 | Class B1 | $2,500 |

Class B2 Class C | Class B2 Class C | $2,000 $1,500 |

Outpatient | NA | NA |

Day Surgery / Short Stay Wards | Non-Subsidised | $2,000 |

Subsidised | $1,500 |

The minimum deductible required for hospitalisations is the lower of the amount listed for (i) the targeted coverage for the IP; and (ii) the ward class utilised by the insured person. E.g. An IP with coverage targeted for Class B1 wards will be required to impose a minimum deductible of S$2,500 for insured persons who utilise Class B1, Class A or private wards, $2,000 for insured persons who utilise Class B2 wards, and $1,500 for insured persons who utilise Class C wards.

ANNEX B

Illustration of Claims Payout and Premium Savings Under New Rider Design

Case Example 1

1. 60-year-old Singaporean (“Mr A”) currently holds a private hospital IP with rider. He decides to switch from his existing plan to the new rider in April 2026. By switching, he immediately saves 30% in premiums, or $1,600 in cash that year.

2. Three years later, Mr A undergoes a knee joint replacement surgery in a private hospital and incurs a bill of $56,900 (Table 1).

a. With the new rider, Mr A pays the IP deductible of $3,500, followed by 5% of the remaining bill amount, totalling $6,170. This is entirely covered by MediSave, based on the applicable withdrawal limits.

b. Compared to his previous rider policy, he has to pay $3,330 more in MediSave ($6,170 - $2,840) for his hospital bill.

c. However, by switching to the new rider, Mr A had already saved $4,800 of rider premiums in cash over the last three years.

Table 1: Bill breakdown if Mr A undergoes knee joint replacement

surgery at a private hospital*

3. In the future years, Mr A can look forward to more years of rider premium savings, and the annual savings will also rise, as premiums rise with age. While he would have a higher copayment should he be hospitalised, this is typically not a frequent occurrence; an average 60-year-old will undergo day surgery or hospitalisation about two times in their next 10 years.

Case Example

1. 40-year-old Singaporean (“Mrs B”) is currently on a private hospital IP. She did not buy a rider previously as the premiums were too high for her budget.

2. With the new riders being cheaper, Mrs B decides to add a private hospital rider to her IP in April 2026. In doing so, she obtains additional coverage over large medical bills, while paying $500 less each year compared to her peers who had bought riders previously.

3. In December 2026, Mrs B tears her knee while playing sports and undergoes an anterior cruciate ligament (ACL) reconstruction surgery in a private hospital (Table 2). She incurs a bill of $38,700 (Table 2).

a. For this surgery, her IP deductible and co-payment come up to $5,260 ($3,500 + $1,760), of which $3,900 can be covered by MediSave, based on the applicable withdrawal limits.

b. With a rider, she receives $1,760 more in coverage for her surgery, reducing her out-of-pocket expenses (after MediSave) to $1,360, compared to $3,120 without a rider. She also obtains the assurance that her co-payment component each year (excluding deductible) will not exceed $6,000 if she sees a panel doctor.

Table 2: Bill breakdown if Mrs B visits a private hospital for ACL reconstruction surgery*

4. In the future years, Mrs B can look forward to more years of these savings, and the annual savings will also rise, as premiums rise with age. The savings in the long run can be significant, and this may outweigh the higher co-payment involved should she be hospitalised, especially as this is typically not a frequent occurrence; an average 40-year-old will undergo day surgery or hospitalisation only about once or twice in their next 20 years.

Explanatory Notes:

· Premium savings are calculated based on the weighted average premiums for private hospital riders with maximum coverage among insurers, for plans available for sale as of November 2025. Actual premiums will vary over time, as insurers may revise premiums. Premiums may also differ according to insurer, plan type, and policyholder-specific reasons (if any). The calculations do not account for inflation and premium adjustments.

· Bill size and claims frequency figures are from MOH’s claims data. Bill sizes and MediSave withdrawal amounts are based on the median private hospital bills for these procedures in 2024. Actual bills, insurance payouts, cash outlay, and claims frequency may vary, due to differences in patient’s condition and complexity of treatment, subsidy eligibility, and private insurance coverage.